Recapping a Stellar First Quarter for Stocks

Recapping a Stellar First Quarter for Stocks

Jeff Buchbinder | Chief Equity Strategist

Last Updated:

Additional content provided by Kent Cullinane, Analyst, Research.

With Q1 2024 behind us, we explore top contributors and detractors to performance across various asset classes and sectors. We also compare Q1 performance with our current Strategic and Tactical Asset Allocation Committee (STAAC) positioning.

Starting with the broadest asset classes, global equities, as measured by the MSCI ACWI Index, rose 8.2% in Q1 as inflation continued to abate. Central banks globally pointed to potential interest rate cuts this year, and the possibility of a soft landing continued to boost investor sentiment. In fixed income, the Bloomberg U.S. Aggregate Bond Index finished the first quarter in negative territory, dropping 0.8%, marking the sixth consecutive negative quarter. Although it was another negative quarter for bonds, it appears investors and the Federal Reserve (Fed) may be more aligned in terms of inflation and the number of expected interest rate cuts this year.

Domestic equities, as measured by the S&P 500, added to their strong 2023 returns with a 10.2% first quarter rally, marking its best first quarter since 2019. Not far behind was the technology-heavy Nasdaq Composite’s 9.1% gain, followed by the Dow Jones Industrial Average up 5.6%. Small caps, as measured by the Russell 2000, trailed their large cap peers, rising 5.0% during the quarter. Small caps continue to underperform their large cap counterparts, however, assuming a soft landing (our base-case scenario), low valuations and an improved U.S. economic growth outlook could be tailwinds for this asset class in the future.

Turning to international markets, the MSCI EAFE gained 6.0% in the first quarter, with Japan a sizable contributor for the developed international equity index. Emerging markets (EM) continued to underperform broader developed markets as China, making up nearly a quarter of the EM index, closed the first quarter in negative territory in U.S. dollar terms.

In terms of investment styles, growth stocks continued to outpace their value stock counterparts, as the Russell 1000 Growth Index gained 11.3% compared to 8.9% for the Russell 1000 Value Index. Below is a chart highlighting trailing performance across various equity asset classes.

Strong First Quarter for Domestic Large Cap Growth Stocks

Source: LPL Research, FactSet, 04/01/24

Disclosures: All indexes are unmanaged and can’t be invested in directly. Past performance is no guarantee of future results.

As far as domestic equity sectors are concerned, energy outperformed all other sectors, rising 13.5% during the first quarter, as higher oil prices contributed meaningfully to outperformance. Following energy, communication services, financials, and industrials each rose by double-digits. While no sector finished the quarter in the red, consumer discretionary was the largest detractor from performance, rising 3.1%.

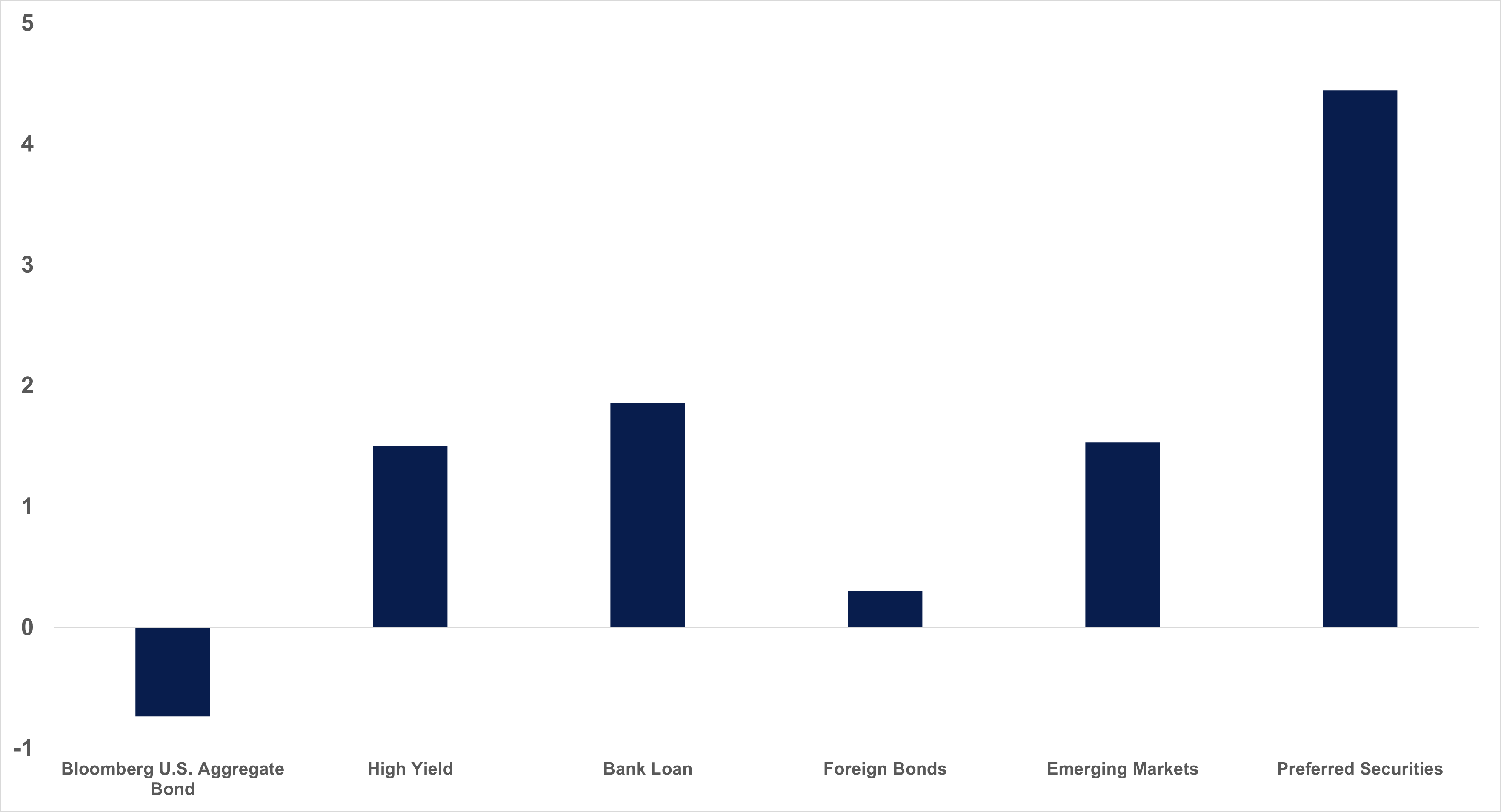

Within bonds, spread sectors such as high-yield corporates and bank loans outperformed their investment-grade peers, gaining 1.5% and 2.5%, respectively. Preferred securities outpaced all other fixed income asset classes, rising 4.5% as the sell-off in the banking sector roughly a year ago provided an attractive opportunity to invest in these senior securities. Overseas, foreign bonds rose a marginal 0.3%, with emerging market bonds contributing to the positive performance, adding 1.5% over that period.

Preferred Securities Delivered Strong First Quarter Returns in a Tough Environment

Source: LPL Research, FactSet, 04/01/24

Disclosures: All indexes are unmanaged and can’t be invested in directly. Past performance is no guarantee of future results.

When comparing the latest LPL Research STAAC views with Q1 2024 performance, there are a number of areas in which LPL’s tactical guidance has benefitted client portfolios. The STAAC maintained an overweight to large cap equities over mid- and small-caps through much of the first quarter, benefiting from mega cap technology leadership. Additionally, the STAAC favored, and still favors domestic equities over foreign, as the U.S. economy continues to outgrow most other developed and emerging markets. Finally, the STAAC favored growth-style equities over value throughout the first quarter, and still does, although the tactical overweight was reduced in mid-March as technology sector momentum began to wane and value stock performance began to improve.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value